Your Giving Legacy.

Invested in Faith.

FUND ADVISOR PORTAL

New and Improved Fund Advisor Portal

Recent upgrades will allow you to easily view your gifts, grants, and fund balances. At a glance, you will be able to view your quarterly fund statements. Fund Advisors can also conveniently recommend grants online to your favorite charities!

Fund Advisor Portal Video Guide

FALL 2023 GRANT PROGRAM RECIPIENTS

St. Francis de Sales Church

St. Pius Catholic Church

Resurrection Catholic School

Didde Catholic Campus Center

Office of Catholic Schools

Bishop Ward High School

St. John the Evangelist, Lawrence

Christ the King Catholic School

Xavier Catholic School

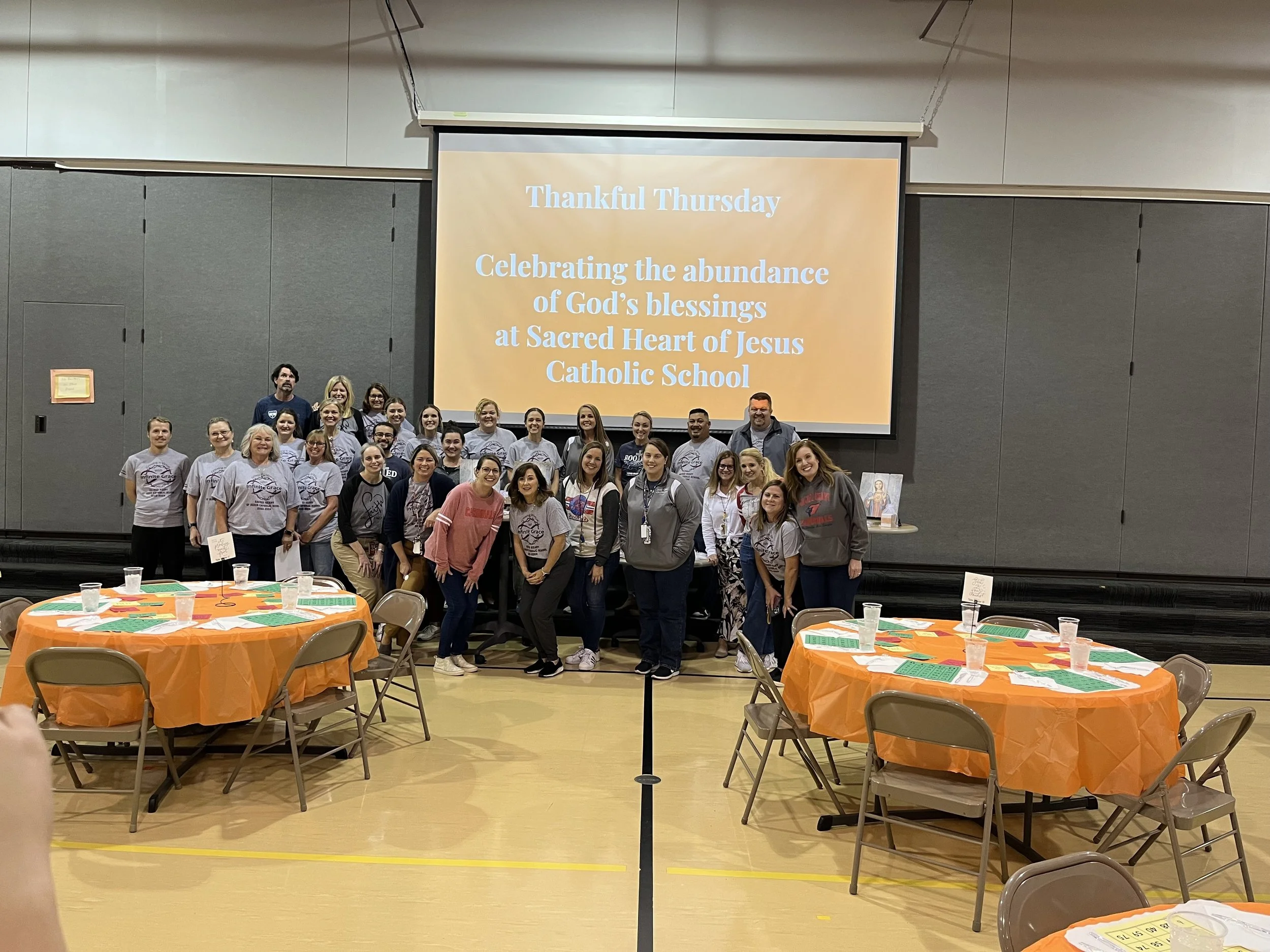

Sacred Heart of Jesus Catholic School

Newsletter

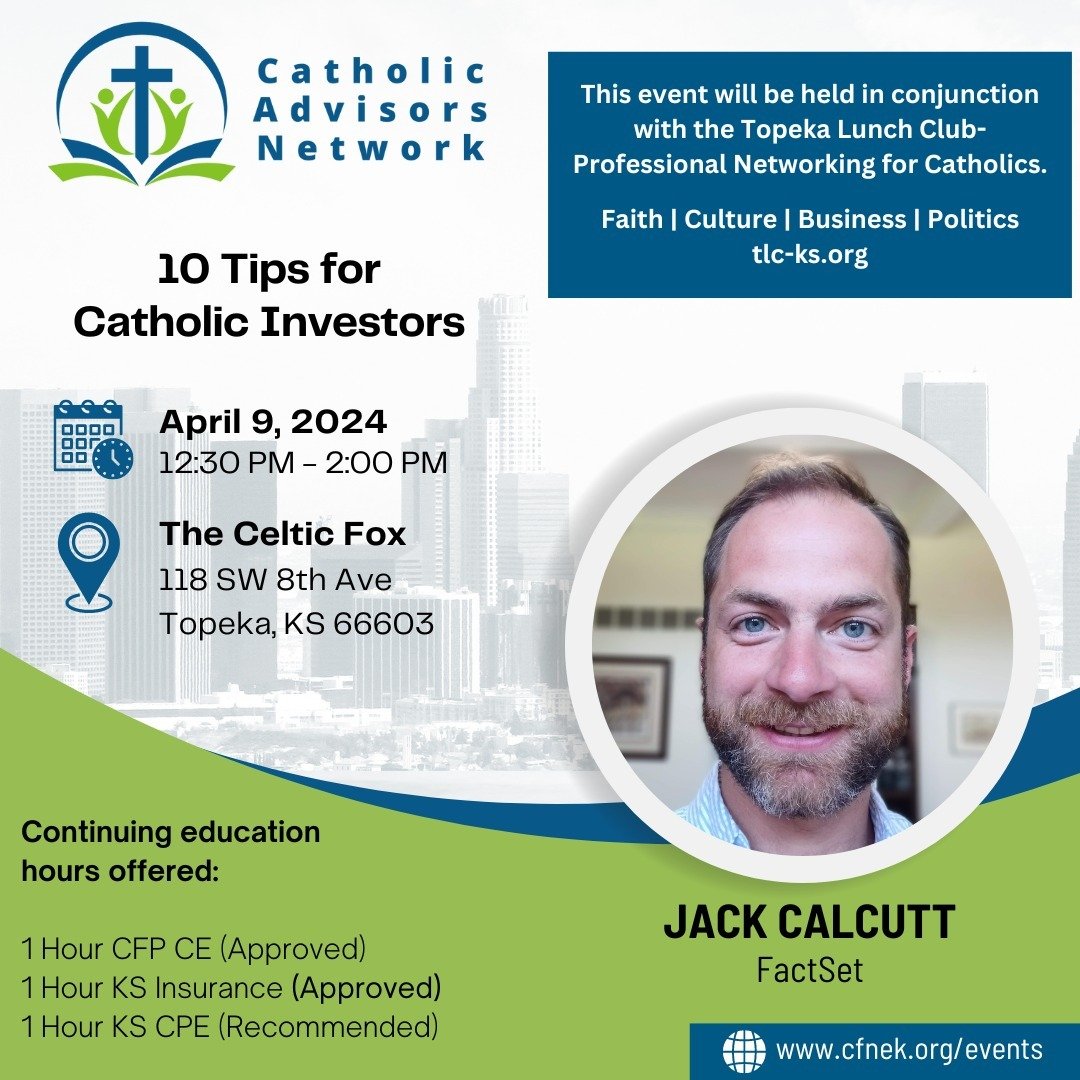

Upcoming Events

Follow us on Instagram

Contact Us.

For more information about starting a fund please complete the form below and we’ll get back to you shortly.